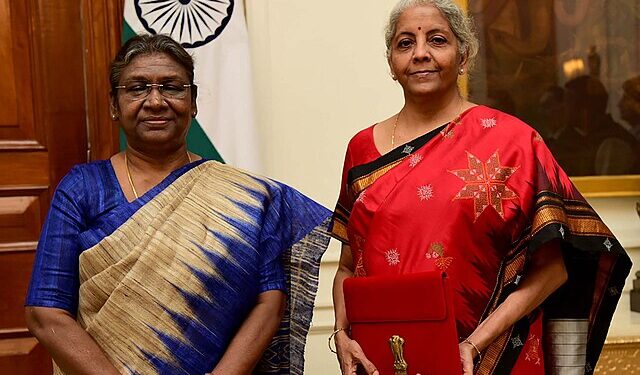

The Indian government’s Budget 2025 has introduced several changes to impact Non-Resident Indians (NRIs) significantly. While the budget aims to streamline India’s fiscal policies and boost economic growth, it has also created a more complex financial landscape for NRIs, particularly in areas such as taxation, investments, and remittances. Experts suggest that these changes could have far-reaching implications for NRIs’ financial planning and their ties to India.

Key Changes in Budget 2025 Affecting NRIs

- Revised Tax Regime for NRIs

One of the most significant changes in Budget 2025 is the introduction of a revised tax regime for NRIs. The new rules aim to bring greater transparency and curb tax evasion but have also added layers of complexity.- Global Income Taxation: The budget proposes that NRIs earning above a certain threshold will now be subject to taxation on their global income, not just income generated in India. This marks a departure from the previous system, where NRIs were taxed only on income earned within India.

- Double Taxation Avoidance Agreements (DTAA): While India has DTAAs with several countries to prevent double taxation, the new rules could still lead to confusion and additional compliance burdens for NRIs. Experts warn that NRIs may need to seek professional advice to navigate these changes effectively.

- Stricter Rules on Remittances

The budget has also introduced stricter remittance regulations, which could affect how NRIs send money back to India.- Reduced Limit for Tax-Free Remittances: The tax-free limit for remittances has been reduced, meaning that NRIs may now have to pay taxes on larger amounts of money sent to India.

- Increased Scrutiny: The government has announced enhanced scrutiny of high-value remittances to curb money laundering and illegal transactions. While this move is aimed at improving financial security, it could lead to delays and additional paperwork for NRIs.

- Changes in Investment Rules

Budget 2025 has also brought changes to the rules governing NRI investments in India, particularly in real estate and financial markets.- Higher Capital Gains Tax: The budget proposes an increase in capital gains tax on property sales by NRIs. This could discourage NRIs from investing in Indian real estate, which has traditionally been a popular investment avenue.

- Restrictions on Repatriation: New restrictions on the repatriation of funds from certain investments could make it harder for NRIs to move their money out of India. This is likely to impact long-term investment decisions.

- Impact on NRI Savings and Retirement Plans

The budget’s changes could also affect NRIs’ savings and retirement plans, particularly those who rely on investments in India for their future financial security.- Reduced Interest Rates on NRI Deposits: The budget has proposed a reduction in interest rates on NRI-specific deposits, such as Foreign Currency Non-Resident (FCNR) accounts and Non-Resident External (NRE) accounts. This could make these accounts less attractive to NRIs looking for safe investment options.

- Pension and Insurance Reforms: Changes to pension and insurance schemes could also impact NRIs, particularly those who have invested in these products as part of their retirement planning.

Reactions from Experts and Stakeholders

The budget’s impact on NRIs has sparked mixed reactions from experts and stakeholders.

- Concerns Over Compliance Burden: Many financial experts have expressed concerns that the new rules could create a significant compliance burden for NRIs. The need to navigate complex tax laws and reporting requirements could deter NRIs from maintaining financial ties with India.

- Potential Impact on NRI Investments: Real estate and financial market analysts warn that the changes could lead to a decline in NRI investments in India. Higher taxes and stricter regulations may make Indian markets less attractive compared to other global investment destinations.

- Calls for Clarity and Simplification: Some stakeholders have called on the government to provide greater clarity and simplify the new rules to ensure that NRIs can comply without undue hardship.

Long-Term Implications for NRIs

The changes introduced in Budget 2025 are likely to have long-term implications for NRIs and their relationship with India.

- Financial Planning Challenges: NRIs may need to rethink their financial planning strategies, particularly in areas such as taxation, investments, and retirement planning. The increased complexity of the new rules could make it harder for NRIs to manage their finances effectively.

- Impact on Remittances: Stricter rules on remittances could reduce the flow of money into India, which could have broader economic implications. Remittances from NRIs have traditionally been a significant source of foreign exchange for India, and any decline could impact the country’s balance of payments.

- A shift in Investment Patterns: The budget’s changes could lead to a shift in NRI investment patterns, with more NRIs opting to invest in other countries with more favorable tax and regulatory environments.

Government’s Rationale Behind the Changes

The Indian government has defended the changes, stating that they are necessary to improve transparency, curb tax evasion, and boost revenue collection.

- Curbing Tax Evasion: The government has argued that the new rules will help curb tax evasion by NRIs and ensure that they pay their fair share of taxes.

- Boosting Revenue: The changes are also expected to boost government revenue, which can be used to fund development projects and social welfare programs.

- Aligning with Global Standards: The government has stated that the new rules are in line with global standards and best practices, particularly in areas such as taxation and financial regulation.

What NRIs Can Do to Adapt

Given the changes introduced in Budget 2025, NRIs may need to take several steps to adapt to the new financial landscape.

- Seek Professional Advice: NRIs should consider seeking advice from tax and financial experts to understand the implications of the new rules and plan accordingly.

- Review Investment Portfolios: NRIs may need to review their investment portfolios and consider diversifying their investments to minimize risks.

- Stay Informed: Staying informed about the latest developments and changes in Indian tax and financial laws will be crucial for NRIs to navigate the new rules effectively.

Budget 2025 has undoubtedly left NRIs with a more complicated financial future. While the changes aim to improve transparency and boost revenue, they have also created significant challenges for NRIs in areas such as taxation, investments, and remittances. As the new rules take effect, NRIs will need to adapt quickly to ensure that they can continue to manage their finances effectively and maintain their ties with India.