Mumbai, April 19, 2025 – In a pointed address to the country’s financial ecosystem, Reserve Bank of India (RBI) Governor Sanjay Malhotra raised fresh concerns over dwindling liquidity in India’s money markets, calling attention to discrepancies in key short-term interest rates and warning that these could impair effective monetary policy transmission.

Speaking at a recent financial conference—his remarks later published on the RBI’s official website—Malhotra said the emerging asymmetries among the call money rate, market repo rate, and the tri-party repo (TREPS) rate are beginning to raise systemic questions about how efficiently the central bank’s policy decisions are reaching the broader financial markets.

“Worrisome Gaps” in Market Rates

“These asymmetries, which arise from time to time between different money market rates, pose challenges for monetary policy transmission,” Malhotra cautioned.

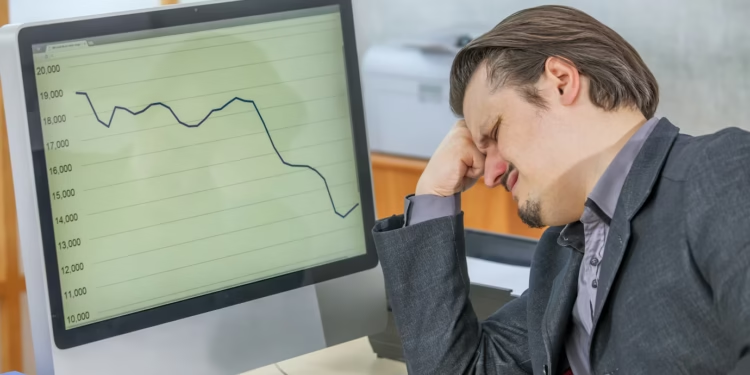

The call money rate, often seen as a barometer of overnight liquidity among banks and financial institutions, has recently shown signs of volatility, occasionally diverging from the policy corridor the RBI intends to maintain. This misalignment undermines the central bank’s efforts to control liquidity and manage short-term borrowing costs, especially when these signals do not reflect the central bank’s intended policy stance.

The situation is particularly concerning in a month where the RBI has, by its own estimate, ensured an average daily liquidity surplus of ₹1.7 trillion ($20 billion)—a stark reversal from the deficit trends observed earlier in the year. Despite this flush of liquidity, uneven pricing in the short-term funding market points to underlying inefficiencies in liquidity distribution and absorption.

RBI Urges Banks to Step Up

Governor Malhotra emphasized that banks—who enjoy exclusive access to the RBI’s liquidity adjustment facilities—must play a more proactive role in ensuring that central bank support translates into real-world financial relief across the system. He urged banks to better manage their liquidity buffers and actively participate in the market to smooth rate discrepancies.

“Transmission begins at the top of the financial pyramid,” said a senior RBI official familiar with the matter. “If the apex institutions don’t ensure flow-through, our liquidity tools lose their efficacy.”

Focus on Strengthening Government Securities and Derivatives Markets

Beyond short-term market concerns, Malhotra also took the opportunity to flag issues in India’s government securities (G-Sec) market, calling for a deepening of participation and improved market-making practices to enhance both price discovery and liquidity.

He stressed the need for greater diversity of views among traders and a more active risk management culture, particularly in interest rate derivatives. This, he said, would foster healthy two-way trade, reduce herd behaviour, and better reflect market fundamentals.

“Market depth, diversity, and competition are critical for efficient transmission,” Malhotra noted. He also hinted that the central bank may consider additional regulatory measures to incentivize broader participation in both the cash and derivative segments of the G-Sec market.

Implications for Monetary Policy

The RBI’s current monetary policy framework relies heavily on fine-tuning liquidity conditions to align short-term interest rates with its benchmark repo rate. But when market participants—especially banks and large non-banking entities—fail to respond uniformly, it creates gaps in the chain of transmission, weakening the RBI’s influence over credit conditions, inflation expectations, and growth momentum.

Analysts suggest that the warning comes at a pivotal time for the Indian economy, as the RBI balances its cautious inflation outlook with the need to support growth in a globally uncertain environment.

“The RBI is clearly signalling that operational gaps—not just policy missteps—can derail financial stability,” said a Mumbai-based fixed income strategist.

The Road Ahead

As India’s financial markets continue to mature, the central bank’s call for greater institutional discipline and market participation signals a shift from simply injecting liquidity to ensuring that liquidity works in the way it is intended. Market players—especially banks—are now expected to not only absorb central bank funds but also facilitate their smooth transmission across sectors.

In the coming weeks, financial market observers will watch closely how banks respond, whether rate disparities narrow, and if systemic liquidity becomes more evenly distributed.

For now, the RBI has fired a clear warning shot: liquidity in the system may be abundant—but unless it’s effectively channelled, it won’t deliver the intended economic impact.