A major new study from the London School of Economics and Political Science has found that ethnic wealth inequalities in the United Kingdom remain entrenched across the entire wealth distribution, with most ethnic minority groups holding substantially less wealth than White British households — even after accounting for income, education and other observable characteristics.

The research, The scale and drivers of ethnic wealth gaps across the wealth distribution in the UK, draws on data from the long-running Understanding Society survey and is the first to examine ethnic disparities not only at the average or median, but across all levels of household net worth.

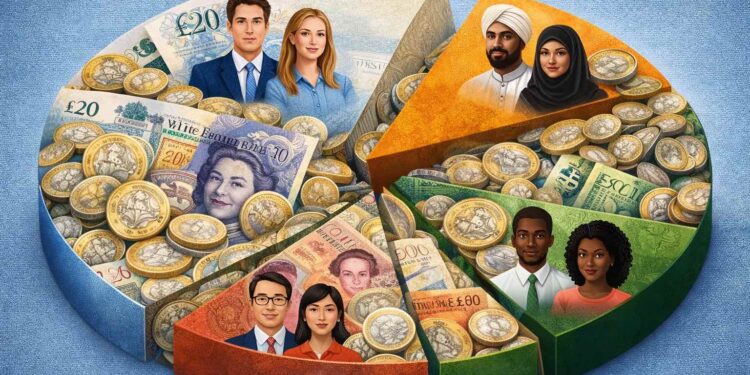

The study shows that all ethnic minority groups except those of Indian origin are consistently worse off than White British households at almost every point in the wealth distribution. In contrast, people from Indian backgrounds emerge as the only ethnic group with higher median household wealth than White Britons.

Stark inequalities at both ends of the wealth scale

According to the study, the median White British household holds around £140,000 in net wealth, while the median household in the Indian ethnic group holds approximately £160,000. By comparison, the typical household from Bangladeshi, Black Caribbean or Black African backgrounds has little to no net wealth.

At the top of the distribution, the gaps widen further. The wealthiest five per cent of White British households hold £893,000 or more in net wealth — nearly three times the £304,000 held by the wealthiest five per cent of Black African households.

At the lower end, the findings point to acute financial vulnerability. Thirty-one per cent of Black Caribbean households, 38 per cent of Bangladeshi households and 44 per cent of Black African households are in net debt, compared with 15 per cent of White British households and 11 per cent of Indian households.

Housing wealth emerges as the central fault line

Housing plays a decisive role in shaping ethnic wealth gaps. With the exception of the Indian ethnic group, all minority groups are significantly less likely to own their homes and tend to have far lower housing equity when they do.

Homeownership rates are highest among Indian households (around 73 per cent), marginally above White British households (around 69 per cent). In contrast, ownership drops sharply among Black African households (19 per cent), Bangladeshi households (26 per cent) and Black Caribbean households (37 per cent).

Crucially, the researchers find that differences in income, education, age, household structure and region do not explain the housing wealth disadvantage faced by most ethnic minority groups, pointing instead to unobserved and structural barriers — including discrimination in housing and mortgage markets.

Debt exposure and low-return assets deepen inequality

Beyond housing, the report highlights persistent gaps in financial wealth. Ethnic minority households are less likely to hold high-return assets such as investment accounts and more likely to rely on financial debt, including overdrafts and credit card borrowing.

Bangladeshi, Black African and Black Caribbean households show the highest levels of indebtedness, often involving high-cost credit. This leaves many families more exposed to economic shocks, particularly amid ongoing cost-of-living pressures.

White British households, by contrast, are up to three times more likely to hold investment accounts than some minority groups, reinforcing long-term wealth accumulation advantages.

Indian-origin households buck the trend, but gaps widen overall

However, the LSE study cautions that this relative success sits alongside widening wealth gaps for other ethnic minority communities, particularly Black African, Black Caribbean and Bangladeshi groups, whose median wealth remains close to zero.

Researchers note that recent wealth growth in the UK has been driven primarily by passive gains from rising asset prices, rather than active savings — benefiting groups already positioned to own property and investments, while leaving others behind.

Structural disadvantages remain entrenched

Even after adjusting for a wide range of observable characteristics, large portions of the ethnic wealth gap remain unexplained, especially in housing wealth. The study concludes that these persistent disparities point to structural and institutional disadvantages, rather than individual choices alone.

Without targeted policy interventions to address access to homeownership, affordable credit and wealth-building opportunities, the researchers warn that ethnic wealth inequalities in the UK are likely to persist — and potentially deepen — in the years ahead.